|

| This one will just have to wait. ☺ |

I'm still overwhelmed after attending the 1st session of Chinkee Tan's "Break Free From Financial Stress" seminar last Saturday. Thanks Jed & Kai for the free invite!

Unfortunately, bad timing for Robinsons' SALE, especially when I'm on the look out for a good blazer - spotted at MEGA's August issue. But just like this MEGA's RESET issue, I'll be doing my own MAJOR RESET by facing the music.

Unfortunately, bad timing for Robinsons' SALE, especially when I'm on the look out for a good blazer - spotted at MEGA's August issue. But just like this MEGA's RESET issue, I'll be doing my own MAJOR RESET by facing the music.

|

| What I learned from this session is more usable than my 3-yr MBA studies |

Chinkee's pointers are still ringing inside my head. Though I've heard and learned most of these before (especially from H), Chinkee's practical insights coupled with his delightful sense of humor and the timing of his seminar unexpectedly urged me (more of, kicked me in the butt) to do something now with my finances.

|

| BOOM! PAK! BANG! OUCH! |

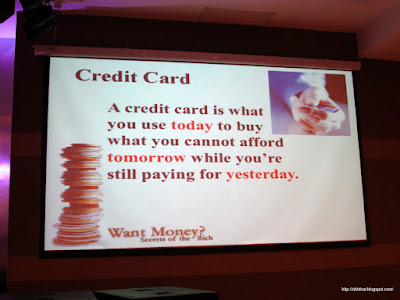

TAMAAA! Of all the notes I took that afternoon, this one hit me right on the spot. (Aray talaga!)

Like most women I know - whenever there's a SALE (which is likely every pay-weekend), my heart would start pumping wildly and I would almost always be tempted to swipe my RED card. (Thank goodness for H, who tremendously helped me with my credit management since we got married.)

Don't get me wrong, the card is not the problem (whew! I can hear my friends from the bank sighing w/ relief). It's actually the habit of borrowing beyond what you can pay now, is the culprit. Yes, debt is a HABIT, and it is rooted in a much deeper problem such as having a "poor man's mindset"... (Plugging: Chinkee Tan's Books)

Realizing that every time I swipe my credit card actually means borrowing (or should I say robbing) my future was a big wake up call. I need to start unlearning this bad habit of money handling & to start building a better one once and for all - a major RESET pls!

Referring to the leaking water bottle illustration - no matter how much water you put in it, it'll never be filled because of its crack/ hole in the bottom. No matter how much my income increases or how much God blesses me with new resources, I'll never be filled to the brim because I'm actually leaking! Debt is what's hindering me from receiving & enjoying God's blessings today. Like the leaking bottle, the only way to solve the problem is to put a tape on it. IT'S TIME for me to correct the problem now! I owe it to myself & to my family (yup including my near-future kids), don't you think?

Can't wait to share my ACTION plans... till the next post!. ;-)

Can't wait to share my ACTION plans... till the next post!. ;-)

|

| Good Mindset (NOW) + Good ACTION (NOW) = Good Results (NOW) |

|

| how i wish money really grow on trees... |

I hope this post encouraged you today. Join the second leg of the seminar, "Rich God, Poor God," on Saturday, August 20, 2011 at Victory Robinsons Metro East, and as Chinkee said, "be financially-stress free!" Registration is still ongoing. (Click here for details)

More of Chinkee Tan at chinkeetan.com.

i love this tin! that's why in our almost 6yr of marriage wala kaming credit card (nakiki swipe lang, hehe). It's ok to splurge once in awhile (you deserve it also-para ndi bitter sa work haha!), as long as nasa budget :)

ReplyDelete